IRR may also be used incorporate financewhen a challenge requires money outflows upfront however then ends in cash inflows as investments pay off. While some favor utilizing IRR as a measure of capital budgeting, it does include problems because it would not keep in mind changing components similar to completely different discount charges. NPV and IRR are two discounted money flow strategies used for evaluating investments or capital projects.

Students should practice Capital Budgeting – CS Executive Financial and Strategic Management MCQ Questions with Answers based on the latest syllabus. If you invest 100 on project B, you will still have 900 in your hand that you can invest on another project, say project C. Suppose you get a return of 20% on project C, then the total return on project B and task C is 230, which is way ahead in profitability. As you observe NPV for investment 2 is higher than that for investment 1. You got this result as cash out flows for investment 2 are at later periods as compared to that of investment 1. However, you may decide on which investment is better only while you know the true worth of the investment as of today.

Since they cannot be expected to yield an adequate commercial return on the funds employed, at least during the short run. After adjusting depreciation tax shield and salvage value, net cash flows and net present value is estimated. Beta Company plans to follow dividend discount model to estimate the cost of equity capital. The Company plans to pay a dividend of Rs.2 per share in the next year. The current market price of Company’s equity share is Rs.20 per equity share.

Net Present Value (NPV) and Internal Rate of Return (IRR) methods yield conflicting outcomes due to _____.

Fixed costs are estimated at Rs. 3 per unit for the same level of production. The conflicts in project ranking in capital budgeting as per NPV… Measure the sensitivity of the project to the change in the level of savings. Measure the sensitivity of the project to the change in the level of running cost. Measure the sensitivity of the project to the change in the level of plant cost.

IRR assumes that the expansion rate remains fixed from challenge to venture. Information on this Website sourced from experts or third party service providers, which may also include reference to any ABCL Affiliate. However, any such information shall not be construed to represent that they belong or represent or are endorsed by the views of the Facilities Provider or ABC Companies.

You are advised to consult an investment advisor in case you would like to undertake financial planning and / or investment advice for meeting your investment requirements. Is owned by Aditya Birla Management Corporation Private Limited and the same is used herein under the License by Aditya Birla Capital Limited and its subsidiary companies (collectively hereinafter referred to as “ABC Companies”). Aditya Birla Capital Limited is the holding company of all financial services businesses.

Net present value is useful in comparing cash flows over a period of time and deciding which one is better. The cash flows can arise at regular, periodical intervals or at irregular periods. ABCL and ABC Companies are engaged in a broad spectrum of activities in the financial services sectors. Any recommendation or reference of schemes of ABSLMF if conflict between npv and irr any made or referred on the Website, the same is based on the standard evaluation and selection process, which would apply uniformly for all mutual fund schemes. Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website.

Cash Flows at Irregular Intervals

Often firms use their weighted common cost of capital as the hurdle fee. Hedge fund managers are also coming beneath pressure from politicians who want to reclassify performance charges as odd revenue for tax purposes, quite than capital positive aspects. In March 2019, Congressional Democrats reintroduced legislation to finish the much-reviled “carried curiosity” tax break. The inside rate of return is a metric used in capital budgeting to estimate the profitability of potential investments. The inside rate of return is a reduction fee that makes the web current worth of all cash flows from a specific venture equal to zero. WACC, or Weighted Average Cost of Capital, is a monetary metric used to measure the price of capital to a firm.

Why is there a conflict between NPV and IRR?

When analyzing a typical project, it is important to distinguish between the figures returned by NPV vs IRR, as conflicting results arise when comparing two different projects using the two indicators. Typically, one project may provide a larger IRR, while a rival project may show a higher NPV.

If an expected rate of return is above the hurdle rate, the investment is taken into account sound. If the rate of return falls beneath the hurdle price, the investor could choose not to move ahead. Thecompound annual progress fee measures the return on an funding over a sure time frame. While CAGR merely uses the beginning and ending value, IRR considers multiple money flows and intervals – reflecting the fact that cash inflows and outflows typically constantly occur in terms of investments.

Project Y has a high standard deviation but a low coefficient of variation as compared to Project X. Project X has a low standard deviation but a high coefficient of variation as compared to Project Y. You are considering two projects namely Project X and Project Y. Project D, which has abetaofl.00 and an expected return of 15.8%. Project C, which has a beta of 1.25 and expected to return 18.2%. Project B, which has a beta of 2.50 and expected to return 25.4%.

Internal Rate of Return (IRR)

The paper exhibits that a firm’s implied price-of-capital is a operate of its trade membership, B/M ratio, forecasted lengthy-term progress fee, and the dispersion in analyst earnings forecasts. Moreover, a agency’s overall cost of capital, which consists of the two kinds of capital prices, can be estimated using the weighted average price of capital model. This may be troublesome when two initiatives require a considerably completely different quantity of capital outlay, but the smaller project returns a better IRR. Internal rate of return is measured by calculating the rate of interest at which the current value of future cash flows equals the required capital investment. The benefit is that the timing of cash flows in all future years are considered and, subsequently, each money circulate is given equal weight by utilizing the time value of cash.

Under what circumstances NPV and IRR differ?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Any information provided or sourced from ABCL Affiliate belongs to them. ABCL is an independent entity and such information from any ABCL Affiliate are not in any manner intended or to be construed as being endorsed by ABCL or Facilities Provider. The information does not constitute investment or financial advice or advice to buy or sell, or to endorse or solicitation to buy or sell any securities or other financial instrument for any reason whatsoever.

But in case of funds constraints ranking may differ so acceptance will depend on the evaluation criteria being adopted. The market prices used to measure costs & benefits in project analysis, may not represent social values due to market imperfections. Several hundred crores of rupees are committed every year to various public projects. Analysis of such projects has to be done with reference to social costs and benefits.

The UGC NET of June 2020 for Commerce was conducted on 17 October 2020. This time the paper was held in 2 separate shifts and thus 2 papers were released. Ranking Conflicts In a given set of Projects, preference ranking tends to differ from one criterion to other criterion. For example NPV and IRR criteria may yield different preference rankings similarly preference ranking conflict may arise between NPV and BCR methods.

The outlay would be ₹ 12,50,0 & the total NPV would be ₹ 2,15,000. The machine has to be written off over a period of 5 years by SLM. Ownership of the asset remains with the lessor for the entire lease period. The period of the lease will cover all, or substantially all, of the useful economic life of the leased asset. In this situation, we need to rely on the profitability index method and choose the one with the highest PI.

Calculating Term of Loan

You may choose not to create One ID in which case you will not be able to display all your products across ABC Companies on one page. This Agreement describes the terms governing the usage of the facilities provided to you on the Website. Clicking “I Agree” to “Terms & Conditions”, shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000. Depending on the calculation, investors can decide whether a particular investment is ideal or should be avoided . Investments with higher NPVs are considered to be more advantageous.

Will a conflict exist between the NPV and IRR?

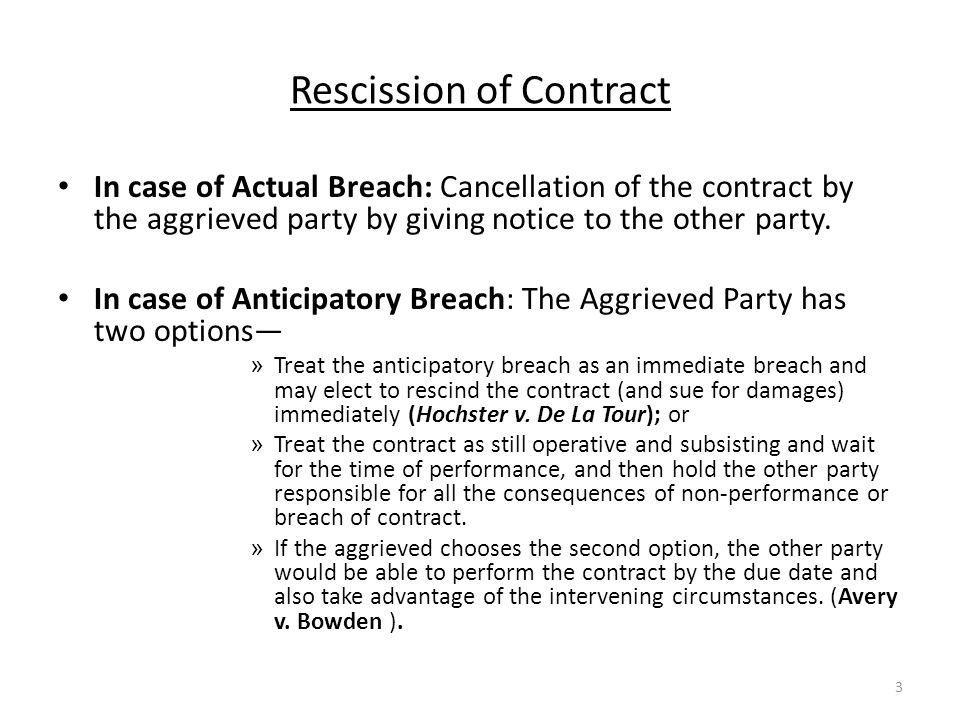

A conflict will exist between the NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, if the projects' cost of capital is less than the rate at which the projects' NPV profiles cross.

Project Beta because it has a higher internal rate of return. In relation to capital budgeting, sensitivity analysis deals with the consideration of the sensitivity of the NPV to different variables contributing to the NPV. Use the common-life technique to replicate the one-year project three times and recalculate the NPV and IRR for the one-year project. Coefficient of VariationSelect the correct answer from the options given below. Consider a case when your finance rate is different from your reinvestment rate.

Disadvantages of Net Present Value (NPV) for Investments

This compensation is not allowed as deduction for tax purposes. Assuming that projects are indivisible and there is no alternative use of the money allocated for capital budgeting on the basis of P.I. So, NPV is much more reliable when compared to IRR and is the best approach when ranking projects that are mutually exclusive. Actually, NPV is considered the best criterion when ranking investments. The reason the two above-mentioned options works is because a company’s objective is maximizing its shareholder’s wealth, and the best way to do that is choosing a project that comes with the highest net present value. Such a project exerts a positive effect on the price of shares and the wealth of shareholders.

- If the company is in the process of selecting one of the two machines, the decision is to be made on the basis of independent evaluation of two machines by comparing their Net-present values.

- Hence the hurdle rate can be referred to as the corporate’s required rate of return or target rate.

- Calculate the IRRs of these investments to be certain that the IRRs are greater than the cost of capital.

- Note − the first date in your data must be the earliest of all the dates.

Although IRR is an interesting metric to many, it ought to always be used at the side of NPV for a clearer image of the worth represented by a possible venture a agency may undertake. When going through such a scenario, the challenge with the next NPV should be chosen because there’s an inherent reinvestment assumption. If the IRR of a new project exceeds a company’s required rate of return, that project will most likely be accepted. If IRR falls below the required rate of return, the project should be rejected. It compels the decision-maker to identify the variables which affect the cash flow forecasts.

Incorporated in 2007, ITCONS E-Solutions Limited is a New Delhi-situated company engaged in the business of providing human resource services. The Website specifically prohibits you from usage of any of its facilities in any countries or jurisdictions that do not corroborate to all stipulations of these Terms of Use. The Website is specifically for users in the territory of India.

The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you. The results provided by the Planner are generic in nature and do not necessarily reflect the actual investment profile that you may hold and it is not necessary for you to act on it. The Planner provides a generic indication of your money needs to enable you to prioritize your investment needs which are rule based. Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive. The financial services industry in India has witnessed a phenomenal growth, diversification and specialization since the initiation of financial sector reforms in 1991. Greater customer orientation is the only way to retain customer loyalty and withstand competition in the liberalized world.

Under what circumstances NPV and IRR differ?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Leave A Comment